THE PROBABILITY OF COLLECTING PAST DUE COMMERCIAL DEBTS

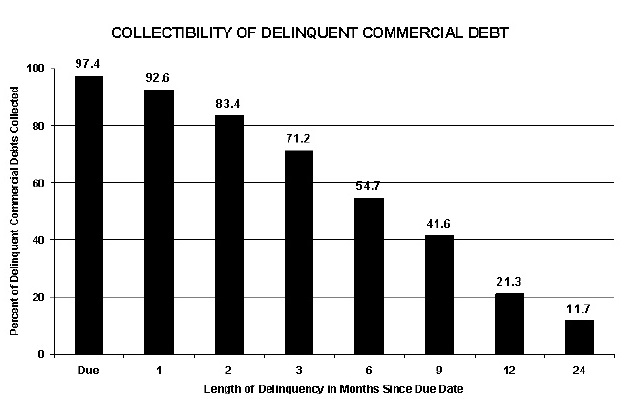

The results of a recent survey of members of the Commercial Collection Agency Section (CCAS) of the Commercial Law League of America (CLLA) show that at three months delinquent, 30% of accounts receivable will not be collected; at six months delinquent, over 45% of accounts receivable will never be recovered; and at twelve months delinquent, almost 80% of delinquent accounts will have to be written off. The results of this survey are an update from a similar survey conducted by the CCAS in 1997.

In our current economic times management understands that it is more important than ever to manage your costs of doing business. They understand that cash flow is the engine that drives businesses large and small and that delinquent accounts are the brakes that bring companies to a screeching halt. The current economic conditions have pushed many companies to extend the time they will permit an account to age prior to instituting formal collection efforts. This loosening of payment requirements may be severely impacting company’s cash flow and bottom line. This chart clearly demonstrates the importance of taking immediate action when an account ages past its due date. Past due accounts can play havoc on a company’s liquidity and tie up staff time that could be put to much better use. Companies must take a hard line on past due receivables and turn to professional help when their efforts have not proved successful.